Are you ready to elevate your trading game? If you’ve been on the lookout for effective patterns that can enhance your analysis, the ABC Pattern .328 1.27 might just be your next go-to tool. This powerful technique has gained traction among traders worldwide and offers a systematic approach to identifying potential price movements.

Imagine having a reliable framework at your fingertips—one that helps you make informed decisions while navigating the unpredictable world of financial markets. Whether you’re a seasoned trader or just starting, understanding this pattern could be key to unlocking new opportunities and minimizing risks in your trades.

Let’s dive deeper into what makes the ABC Pattern so compelling and how it can become an integral part of your trading strategy!

Understanding the ABC Pattern

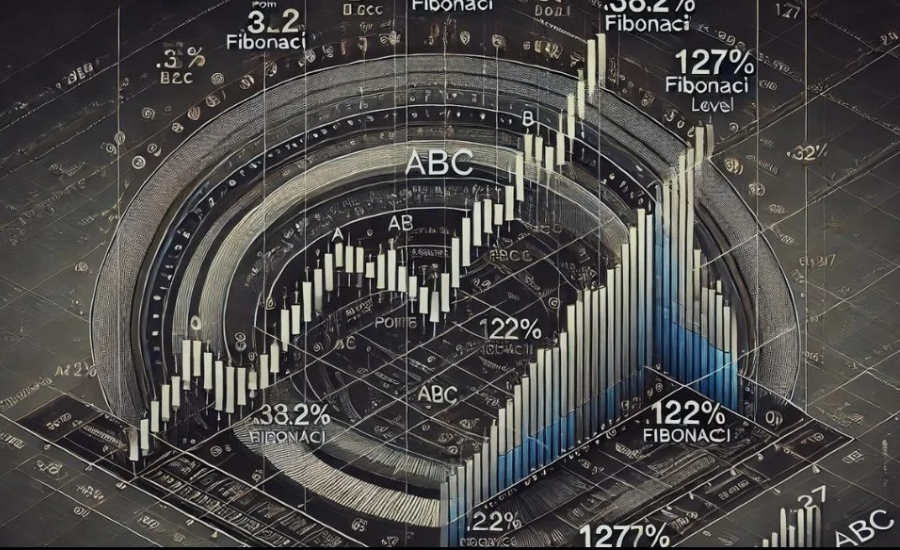

The ABC Pattern is a technical analysis tool that traders use to anticipate price movements. It consists of three main points: A, B, and C. These points create a distinct shape on the price chart, resembling a zigzag pattern.

Point A marks the starting position before any significant move occurs. From there, prices rise to point B, establishing an initial high. However, they don’t hold this momentum and eventually fall back to point C.

This pullback signals potential support or resistance zones where traders can capitalize on upcoming trends. Importantly, recognizing these patterns early allows for strategic entry and exit points in trades.

Traders often look for specific Fibonacci retracement levels between these points to enhance their predictions further. Understanding how each segment interacts helps refine your trading strategy and boosts your confidence in making informed decisions.

The History of ABC Pattern .328 1.27

The ABC pattern .328 1.27 has its roots in classical technical analysis, emerging from the need for traders to identify price reversals. This methodology gained traction during the late 20th century when market analysts sought to refine their tools.

As trading became increasingly sophisticated with technology, the ABC pattern evolved. Traders began applying Fibonacci ratios like .328 and 1.27 to enhance precision in predicting market movements. These specific levels provide insight into potential support and resistance areas.

Over time, more traders adopted this strategy, contributing to a rich community of practitioners who share insights and strategies online. The accessibility of educational resources further propelled its popularity among both novice and experienced investors looking for reliable patterns in volatile markets.

Understanding this history deepens one’s appreciation for the ABC pattern as not just a tool but also part of an ongoing dialogue within financial circles about effective trading strategies.

How to Use ABC Pattern .328 1.27 in Trading

To effectively use the ABC Pattern .328 1.27 in trading, start by identifying key price points. Look for point A, where a significant move begins. This is followed by point B, which represents a retracement.

Next, observe point C, where the market reverses again and heads toward its next potential move. The relationship between these points helps traders anticipate future price movements.

Once you’ve mapped out these points on your chart, apply Fibonacci retracement levels to determine potential entry and exit areas. The .328 level often indicates a reversal zone that can be worth watching for buy or sell signals.

Always remember to combine this pattern with other indicators like volume analysis or trend lines for confirmation before executing trades. Being patient and waiting for clear signals can enhance your success rate significantly when utilizing this pattern in your strategy.

Examples and Case Studies of Successful Trades Using ABC Pattern .328 1.27

Many traders have found success using the ABC Pattern .328 1.27 in various market conditions. One notable example occurred in the forex market, where a trader identified a bullish ABC pattern on the EUR/USD pair. By entering at point C and setting their target at point D, they capitalized on a significant price surge.

In another case, an investor analyzed stock charts for tech companies and spotted an ABC formation during a consolidation phase. They placed trades based on Fibonacci extensions to maximize gains when the stock broke out of resistance.

These real-world applications demonstrate how versatile this pattern can be across different assets. Successful traders often refine their strategies by studying these patterns closely, adapting them according to specific market dynamics while keeping risk management top of mind.

Common Mistakes to Avoid When Utilizing ABC Pattern .328 1.27

Many traders stumble when interpreting the ABC pattern .328 1.27 due to a lack of understanding of its nuances. One common error is misidentifying points A, B, and C. This can lead to false signals that disrupt your trading strategy.

Another mistake involves neglecting proper risk management. Setting stop-loss orders is essential for protecting your capital against unforeseen market moves.

Additionally, some traders fail to wait for confirmation before entering a trade based on this pattern. Rushing in without verifying price action can result in unnecessary losses.

Ignoring market context is another pitfall worth mentioning. The ABC pattern does not exist in isolation; external factors such as trends or economic news should guide your decisions.

Over-relying on indicators while using the ABC pattern may cloud judgment. It’s vital to balance technical analysis with intuitive decision-making skills for better outcomes.

Tips for Improving Your Trading Skills with ABC Pattern .328 1.27

To enhance your trading skills with the ABC pattern .328 1.27, start by thoroughly backtesting this strategy. Analyze historical data to identify successful trades and learn from losses.

Make use of demo accounts for practice. This allows you to experiment with real-time market conditions without financial risk. Observe how the ABC pattern behaves across different assets and timeframes.

Develop a solid risk management plan tailored to your trading style. Setting stop-loss orders helps protect against significant losses while allowing room for profitable trades.

Stay updated on market news that could impact pricing dynamics. Understanding external factors can give you an edge in recognizing potential patterns earlier than others.

Keep a trading journal documenting every trade decision made using the ABC pattern .328 1.27. Reflecting on past decisions will help refine your approach over time and build confidence in executing trades.

Conclusion

The ABC Pattern .328 1.27 holds significant potential for traders looking to harness its insights. Understanding the nuances of this pattern can lead to more informed trading decisions.

As you explore various strategies, remember that practice is key. The more you familiarize yourself with the ABC configuration, the better you’ll become at spotting opportunities in real-time market conditions.

Engagement with community resources and ongoing education will also enhance your skill set. Learning from others’ experiences can provide fresh perspectives on utilizing this method effectively.

Trading isn’t just about following patterns; it’s about developing a keen intuition over time. Trusting your instincts while backing them up with solid analysis makes all the difference in navigating dynamic markets successfully.

FAQs

The ABC Pattern .328 1.27 is a powerful tool for traders looking to enhance their trading strategy. Mastering this pattern can lead to more informed decisions and better outcomes in the market. As you explore its nuances, remember that practice makes perfect.

Here are some frequently asked questions about the ABC Pattern .328 1.27:

Q: What is the ABC Pattern .328 1.27?

A: The ABC Pattern .328 1.27 represents a specific price movement configuration used by traders to identify potential reversal points in the market.

Q: How do I recognize an ABC Pattern?

A: To spot an ABC pattern, look for three main segments: A (the initial move), B (the retracement), and C (the final move). The ratios of these moves help define whether it fits into the .328 1.27 specifications.

Q: Can beginners use this pattern effectively?

A: Yes! While there’s a learning curve, beginners can certainly utilize the ABC Pattern with proper education and practice.

Q: Are there tools or indicators that help identify this pattern?

A: Many trading platforms offer charting tools that allow users to visualize patterns easily, including Fibonacci retracements which are often helpful in identifying key levels related to the ABC setup.

Q: What should I avoid when using this pattern?

A: Avoid making hasty trades without confirming signals from other technical indicators or fundamental analysis; patience is crucial for successful trading practices involving patterns like these.

By understanding and applying what you’ve learned about the ABC Pattern .328 1.27, you’re on your way toward enhancing your trading repertoire and potentially increasing your success rate significantly.